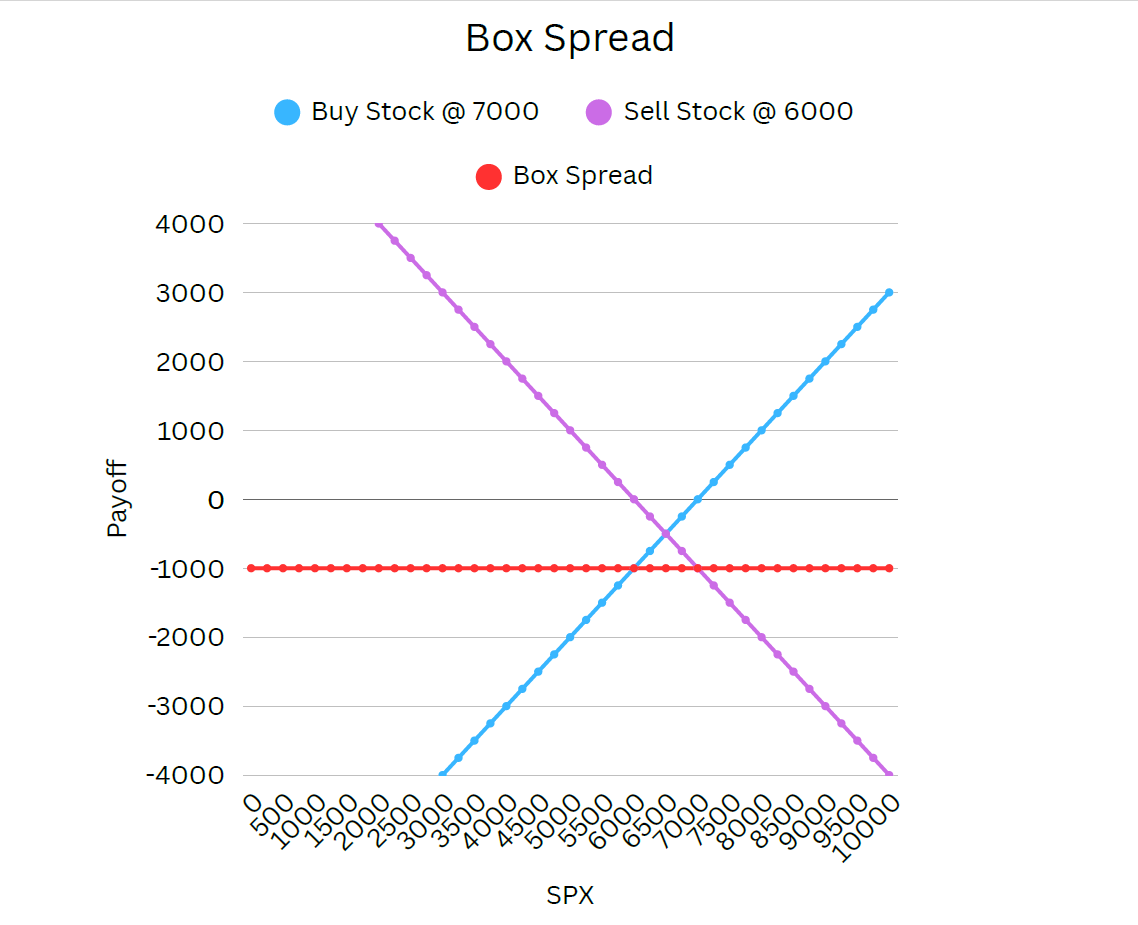

Step 1: Buying a call option at $7000 and selling a put option at $7000 is equivalent to buying stock at $7000.

Step 2: Buying a put option at $6000 and selling a call option at $6000 is equivalent to selling stock at $6000.

Step 3: Combining these two strategies into one package means you will owe $1,000 in the future no matter where the stock goes! However, you will get credited with cash upfront. The amount you are credited determines the interest rate! In this example, if the market pays you $962 today and you owe $1,000 in a year, you will be borrowing at 3.87% annualized!* This is the reason we are able to offer you amazing rates: we are transacting with an efficient market that bids your loan to the lowest possible rate!

*rates approximate as of 9/21/25 and calculated through continuous compounding

Step 4: We trade a box spread on your behalf in your account to get you the best rate in the most convenient way possible.

Further Reading

We realize that the process of executing this strategy is unintuitive and hard to think about for those that are not options professionals. For those that would like to learn more, we would recommend looking at here for the CME Group box spreads explanation.