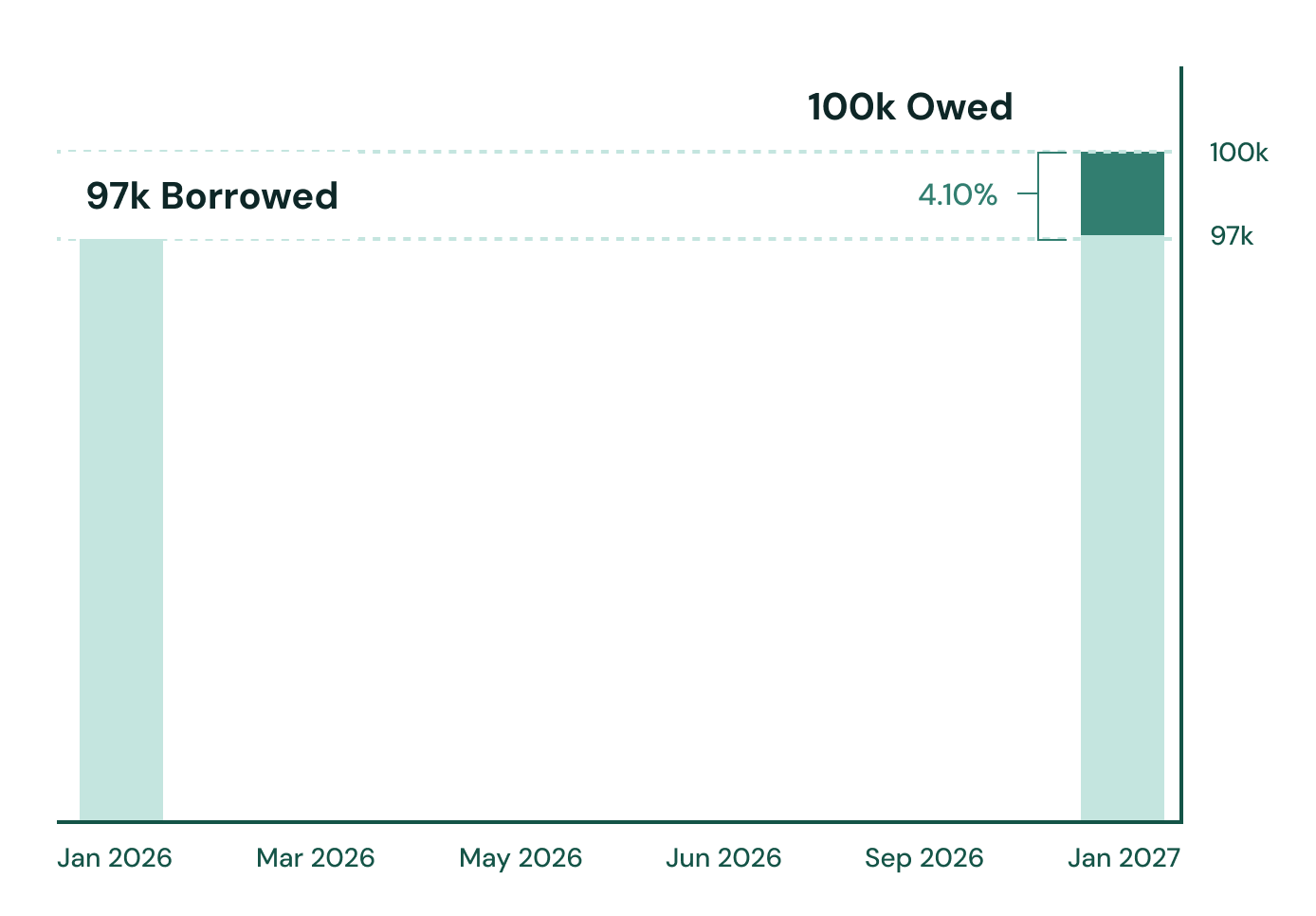

Borrow using the portfolio you already have without selling a single share.

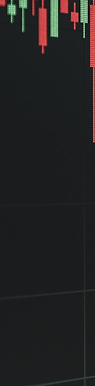

Current rates are 4.10%.

SUPPORTING INVESTMENTS AT

WHY ALTERRA

Not a bank. Not a brokerage.

We’re financial advisors building modern lending the way it should work.

Traditional banks price loans as if you have no financial foundation. Alterra gives you access to the same portfolio-backed lending structures institutions use daily… without the layers of fees, delays, or friction. Your investments stay invested.

HOW IT WORKS

Loans are backed by your existing portfolio and priced by the market.

Home renovations or repairs without personal loans

Liquidity for large purchases without selling your investments

Auto financing that beats dealership terms

Mortgage at rates far below traditional lenders

How Alterra Uses Your Portfolio For Borrowing

ONE

Connect Your Investment Account

You securely link your existing brokerage account — Fidelity, Schwab, Vanguard, or any major provider. Your assets stay exactly where they are.

TWO

We review your holdings to determine your available credit. Choose terms that work for you at market rates.

Review of Available Credit

THREE

Execute Trade and Receive Cash

You receive cash upfront (for example, $100k) and owe a fixed amount in the future (for example, $105k).

FOUR

Stay Fully Invested While You Borrow

No selling, no tax events, no disruption. Your portfolio continues growing while you access liquidity against it.

This structure is common in institutional finance

MORE DETAILS ON HOW IT WORKS

It’s just never been available to everyday consumers.

For decades, large institutions have used options-based lending structures to access predictable funding at transparent costs. These aren’t exotic trades—they’re standardized strategies with clear rules, long histories, and well-understood outcomes.

Our approach makes this same structure accessible in a simplified, consumer-friendly way. You don’t need to be a trader or understand every mechanic. You just benefit from a model that institutions have relied on for years to secure short-term liquidity with a defined repayment schedule.

What a Box Spread Actually Does

How a box spread creates predictable, upfront funding:

A box spread is an options structure that converts the value of future cash into a fixed amount of cash today. When the trade is opened, you receive a lump-sum payment upfront. At a predetermined future date, you pay back a known amount—no surprises, no variable interest.

Because the payoff is locked in, the structure behaves more like a short-term loan with a fixed cost than a speculative trade. There’s no dependency on market direction; the spread has a defined value from the start, which is why experienced traders and institutions use it for efficient financing.

The Tax Benefit

How this structure creates a tax benefit:

In most cases, the cost you pay back on a box spread is treated as a capital loss rather than interest.

For many people, capital losses can offset capital gains, potentially lowering their overall tax burden. In addition, extracting equity via borrowing with box spreads instead of outright selling assets may avoid triggering any capital gains taxes on asset sales.

WHO WE ARE

Alterra is built by former traders and

portfolio managers who believe consumers deserve access to institutional-grade financing.

Traditional lenders rely on outdated risk models and high markups. We don’t.

Frequently Asked Questions

-

Yes. You need a stock or bond portfolio in order to withdraw the cash generated by the box spread. We are currently approved on Charles Schwab and IBKR.

-

You can use the funds for almost any purpose—real estate, business investments, taxes, major purchases, or liquidity needs—without having to sell your investments.

-

Your rate is based on current market conditions, the composition of your portfolio, and your overall loan-to-value ratio. Because your loan is secured by your investments, rates are typically lower than unsecured personal loans or credit cards.

-

Alterra charges a simple 0.50% annualized fee paid monthly.

-

No, and that’s the point! Alterra lets you borrow against your portfolio without selling your assets, so you can stay invested and avoid triggering taxes or disrupting your long-term strategy.

-

Your portfolio remains invested and continues to participate in the market. Your assets are simply pledged as collateral while the loan is outstanding.

-

Your borrowing limit is based on the value and composition of your portfolio. Typically, you can borrow up to 75% of the value of your portfolio, but it varies case by case.

-

Our product carries margin call risk, which occurs if your loan grows too large relative to the value of your portfolio. In that case, you would need to deposit additional cash or assets to bring your loan back within the allowed limit.

-

The only payments you owe are Alterra's fees (calculated as an annualized 0.50% paid monthly).

-

No, securities-backed loans do not impact credit scores or debt-to-income (DTI) calculations.

-

There are two major benefits. First, the difference between the amount owed and the amount you receive upfront is treated as a capital loss, which can potentially offset any capital gains. Second, if you extract cash via borrowing instead of selling assets, you potentially avoid any capital gains taxes on the asset sales. You should consult your tax advisor for guidance specific to your situation.

-

Yes. You retain ownership and control of your portfolio. You can continue to manage your investments as usual, subject to the collateral requirements of the loan.

-

No, we are an SEC-registered investment advisor that executes box spread strategies to get our clients access to efficient funding.